Getting hired in the actuarial field is not easy. The competition is tough.

So how do you stand out?

Of course, with a great resume.

You should start with a strong actuarial resume. It showcases your first impression. In this blog, we’ll walk through how to write a standout resume that gives your actuarial career the little push it needs.

Understanding the Actuarial Job Situation

Traditionally, actuarial roles were confined to the insurance sector. However, with the rise of technologies like data science, AI, and big data analytics, the scope of actuarial work has expanded significantly. Today, actuaries play a pivotal role in helping businesses reshape their risk management strategies. It has positioning them as critical contributors to high-level strategic decisions.

Today actuarial jobs are available across many industries including insurance, consulting, pensions, healthcare, risk management, and banking.

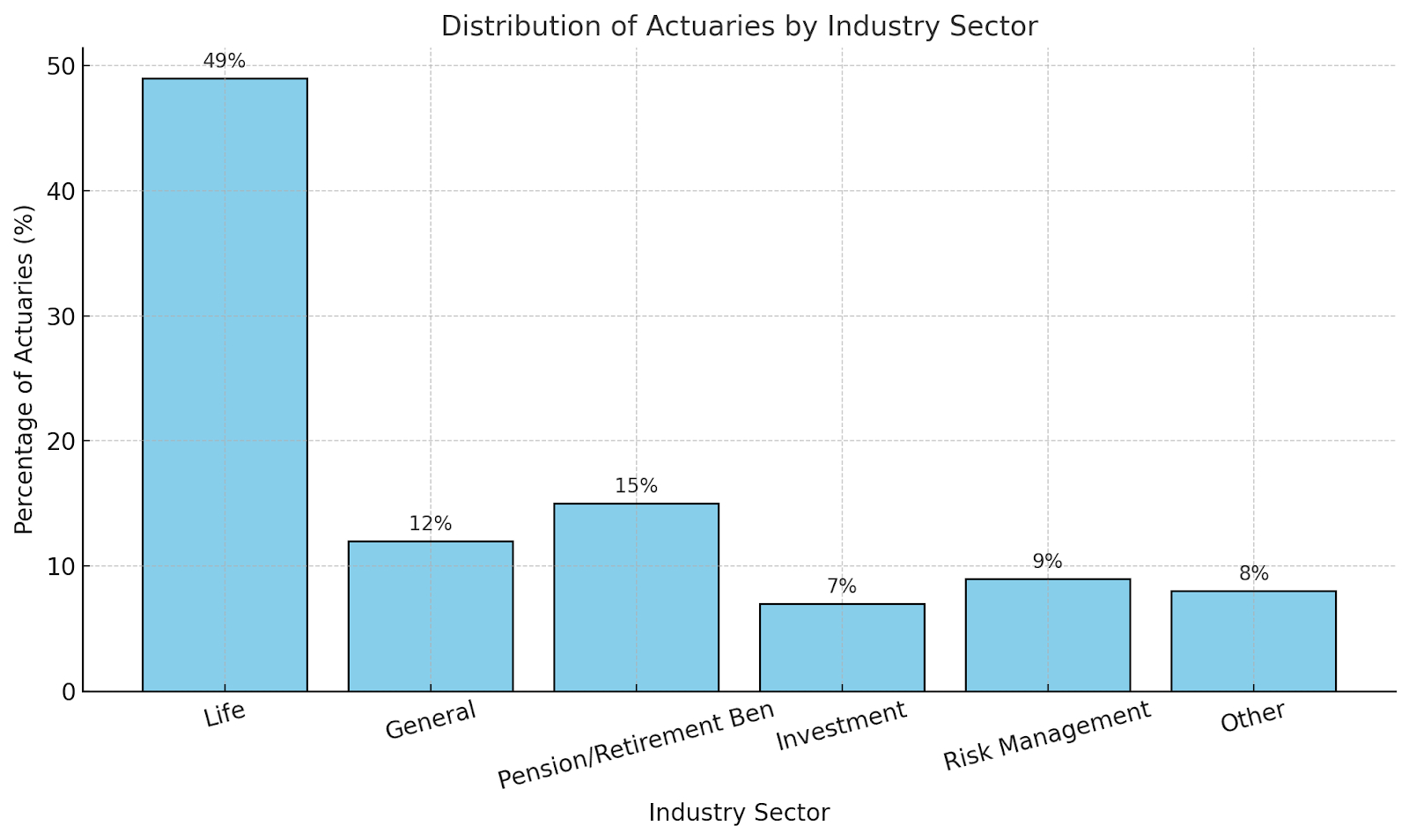

The above graph shows distribution of actuaries in various industries in India. ( Source:https://actuariesindia.org/sites/default/files/2022-05/Actuaries_does_India_need_lesley%20.PDF?utm_source=chatgpt.com)

What Recruiters Look for in an Actuarial Resume

When employers read your resume, they want to see technical ability, solid exam progress, and relevant experience. You must highlight what makes you valuable to their business. Your resume should be tailored to your strengths. Here are the skills that may stand you in front.

- Technical skills: Excel, R, SAS, Python, SQL, and actuarial tools.

- Actuarial exams: Show passed and upcoming exams clearly.

- Internship experience: Quantify impact and results.

- Business sense: Can you explain complex models to non-technical people?

- Soft skills: Good communication, time management, and leadership.

Although your career progression depends upon the test assignments and interview process. However, a standout resume shows results. It proves you have what it takes to grow in your actuarial career.

Key Sections of a Strong Actuarial Resume

1. Header and Contact Info

Start with your name, email, phone, city, and LinkedIn profile. Choose professional fonts.

Example:

Name: ABC

abc@email.com | 987-654-3210 | New Delhi | linkedin.com/in/username

2. Professional Summary

Write 2–3 lines at the top of your resume. This should be a quick intro of who you are and what you bring.

Example:

Analytical actuarial science graduate with 2 internships and Exams P & FM cleared. Seeking entry-level actuarial jobs to apply predictive modeling skills and support risk analysis

3. Technical Skills

Use bullet points or a simple list. Mention software, languages, and tools you’re confident in. Don’t list tools you only used once.

Example:

- Excel (VBA), R, Python, SQL

- SAS, Prophet, Tableau

4. Certifications and Exams

Your actuarial resume should include your exam progress early. Use this section to show passed exams. In India, IAI is responsible for conducting actuaries examination. This exam is divided into 2 types namely, Written and Practical examinations.

5. Work Experience

Use reverse-chronological order. List most recent first. Each job or internship should have a job title, company, dates, and 3–5 bullet points.

Use the STAR method—Situation, Task, Action, Result. Focus on your impact. Always use numbers if you can.

Example:

Actuarial Intern | Bharti Insurance | Jan 2024 – Jun 2024

- Analyzed auto insurance claims data using R, improving pricing model accuracy by 12%.

- Built Excel dashboards for underwriting teams to track high-risk claims.

- Assisted senior actuaries in developing life insurance reserve models.

6. Education

List your degree, university, and graduation date. Mention GPA if it’s strong. Add relevant courses.

Example:

B.Sc. Actuarial Science | University of ABC | Graduated May 2024

7. Projects and Internships

If you’re applying for entry-level actuarial jobs, you may not have full-time experience. In that case, projects matter a lot.

Example:

Risk Management Project: Predicting Health Claim Costs | Jan 2024 – Apr 2024

- Built a logistic regression model using R to predict high-cost patients.

- Achieved 82% prediction accuracy.

- Presented to faculty and local actuarial club.

8. Soft Skills and Extracurriculars

Employers look for well-rounded candidates. Show leadership, team work, or public speaking.

Example:

- Participated in regional actuarial case competition

- Volunteer math tutor for high school students

9. Keywords for ATS

Many companies use Applicant Tracking Systems (ATS). These systems scan your resume for keywords. If you don’t match enough, they reject it even before a human sees it. Hence, keep your resume ATS friendly to get passed through the ATS.

Use keywords from the job posting. Terms like “risk modeling,” “financial forecasting,” “predictive analytics,” should be there in the resume to let the ATS consider your resume as an eligible one.

What Are The Key Steps To Make Resume Standout?

Keep It Neat

Your resume isn’t the place for flashy fonts or over-the-top design. Stick to clean, professional fonts like Arial, Calibri, or Times New Roman, and keep the font size between 10–12 points to maintain clarity and readability.

No Room For Errors: Proofread Before You Send

Before hitting send, follow the golden rule: always proofread. A single typo can make a bad impression and potentially cost you the interview. Use a spellchecker, but don’t stop there—have a friend or two review it for grammar, formatting, and clarity. Your resume reflects your attention to detail, communication skills, and professionalism—make sure it’s spotless.

Include A Professional Summary For Sure

First impressions really matter, and your Professional Summary is where it all starts. Think of it like a quick intro—just a few lines at the top of your resume that show off your best skills and what you bring to the table. No need to tell your whole career story—just make it clear why you’d be a great fit for the job.

Present Your Actuarial Experience

This is the most important part of your resume—your Professional Experience. Most employers don’t spend much time reading resumes, so make it easy for them to spot what matters. Use bullet points to list what you achieved in your past actuarial work.

Since you’re applying for your first job, you should highlight your internship or certification experiences.

Here’s how you can present your experience

- Use numbers to show results. Did you help save money, improve a process, or hit a target? Add stats to prove it.

- Start each bullet with strong action words like “led,” “developed,” “analyzed,” or “organized.” These show you made things happen.

- Don’t just say soft skills—show them. Instead of writing “good team player,” try something like: “Worked with different teams to build a new risk model, cutting claims by 15%.”

- Mention software tools you’ve used—put them under a separate “Technical Skills” section.

- List all your actuarial exams and designations. If you’re still taking exams, show how far you’ve gotten.

Common Resume Mistakes to Avoid

Here are certain common mistakes you should keep in check.

- Listing job duties without showing outcomes

Simply stating your responsibilities doesn’t highlight your value. Focus on achievements and measurable results instead. - Using long paragraphs instead of bullet points Dense text is hard to scan quickly. Use bullet points to improve readability and emphasize key accomplishments.

- Including unrelated jobs or hobbies

Irrelevant experience can dilute your core strengths. Tailor your resume to align with the job you’re applying for. - Overloading your resume with jargon

Excessive technical terms can confuse recruiters. Keep language simple, clear, and accessible to a broader audience. - Forgetting to proofread for grammar and typos Even small errors can appear unprofessional. Always double-check your resume or use a grammar-checking tool.

- Using too many fonts or complex designs

Overly stylized resumes can distract from your content. Stick to clean, professional formatting for a polished look.

Your actuarial resume should be clean, simple, and readable. Avoid color blocks, tables, and images. Focus on content.

Bonus Tips

As of now, you’re good to go with a decent resume. However, here are a few tips to make your resume look even more professional.

- Tailor your resume for each job. Use words from the job post. Take help from AI to customize the resume as per the company requirements.

- Use action verbs like “Analyzed,” “Optimized,” “Built,” and “Created.”

- Keep it to one page, especially for entry-level actuarial jobs.

- Save your resume as a PDF unless told otherwise.

- Use online tools to check readability and formatting.

- Ask mentors, professors, or recruiters to review your draft.

If you’re applying internationally, add an objective statement and follow local formatting styles.

Conclusion

Actuarial jobs have been transformed into multiple other roles. This is the reason for the growing demand of actuaries. Your resume is the first and most important step in landing interviews. It shows your skills, knowledge, and potential. Don’t treat it as a simple checklist. Make every line count.

With a clear format, real impact, and strong keywords, you can create a standout resume. This is your shot at starting or advancing your actuarial career. Get your resume right and everything else follows.

Leave a comment